Saturday 22 March 2025

The quest for optimal reinsurance strategies has been a long-standing challenge in the insurance industry. Insurers face a daunting task of balancing risk and reward while navigating complex market dynamics. A recent study sheds new light on this problem, proposing innovative solutions that cater to heterogeneous beliefs between insurers and reinsurers.

In traditional reinsurance frameworks, insurers aim to minimize their expected losses by transferring risks to reinsurers. However, this approach often neglects the fact that both parties hold different perceptions of risk. The insurer may underestimate the likelihood of catastrophic events, while the reinsurer overestimates them. This mismatch can lead to inefficient risk sharing and suboptimal reinsurance strategies.

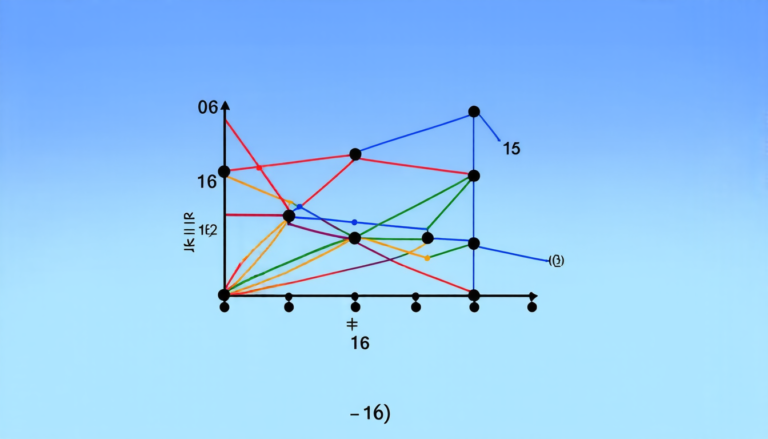

The researchers tackle this issue by incorporating heterogeneous beliefs into a dynamic mean-variance framework. They model the insurer’s surplus process using the classical Cramér-Lundberg risk model, allowing for investment in a risk-free asset. The reinsurer’s behavior is captured through an incentive compatibility constraint, ensuring that both parties act in their best interests.

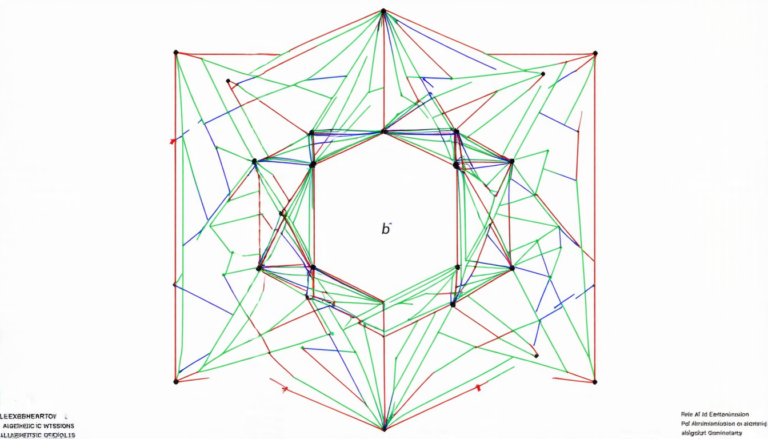

The study reveals that optimal reinsurance contracts are more complex than traditional proportional and excess-of-loss contracts. By assuming specific forms of belief heterogeneity, the authors derive parametric solutions, providing a clear understanding of the optimal equilibrium solution.

One of the key findings is the importance of considering the insurer’s risk tolerance in determining the optimal reinsurance strategy. The researchers demonstrate that a higher risk tolerance can lead to more aggressive reinsurance strategies, as the insurer is willing to take on more risk to maximize returns. Conversely, lower risk tolerance leads to more conservative approaches.

The study also highlights the significance of the reinsurer’s risk aversion in shaping the optimal contract. When the reinsurer is highly risk-averse, they tend to prefer contracts with higher premiums and lower coverage levels. This can result in a suboptimal allocation of risk between the insurer and the reinsurer.

The implications of this research are far-reaching. Insurers and reinsurers can use these findings to develop more sophisticated reinsurance strategies that account for heterogeneous beliefs. By acknowledging and managing the differences in risk perception, both parties can achieve better risk sharing and improved financial performance.

Moreover, the study provides a framework for insurers to assess their own risk tolerance and adjust their reinsurance strategies accordingly. This can help them navigate complex market dynamics and make more informed decisions about risk transfer.

In summary, this research offers a fresh perspective on optimal reinsurance strategies by incorporating heterogeneous beliefs into the analysis.

Cite this article: “Heterogeneous Beliefs in Reinsurance: A New Perspective”, The Science Archive, 2025.

Reinsurance, Risk Management, Insurance, Heterogeneity, Beliefs, Risk Sharing, Optimal Contracts, Dynamic Mean-Variance Framework, Cramér-Lundberg Model, Incentive Compatibility Constraint