Monday 07 April 2025

The world of finance is filled with risk, and managing that risk is crucial for financial stability. One way to do this is by using something called distortion risk measures. These measures allow us to quantify the uncertainty associated with a particular investment or portfolio, giving us a better understanding of how much we might stand to lose.

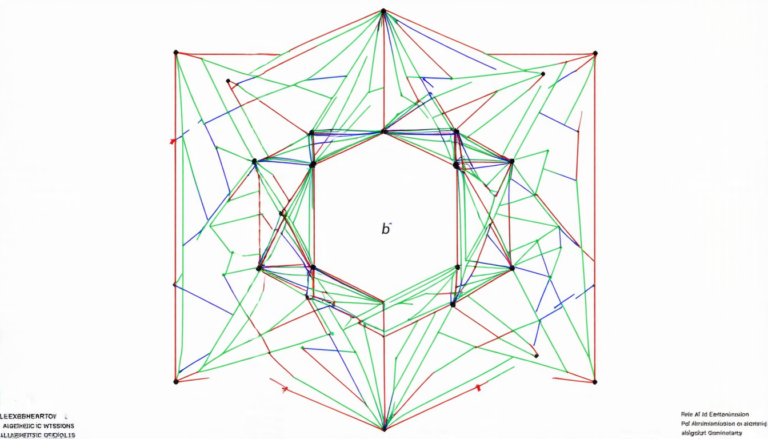

Distortion risk measures are based on a concept called comonotonicity, which refers to the idea that two random variables can be combined in such a way that their joint distribution is still monotonic. In other words, if one variable increases, the other will also increase, and vice versa. This property is important because it allows us to use these measures to calculate the risk of a portfolio by combining individual risks.

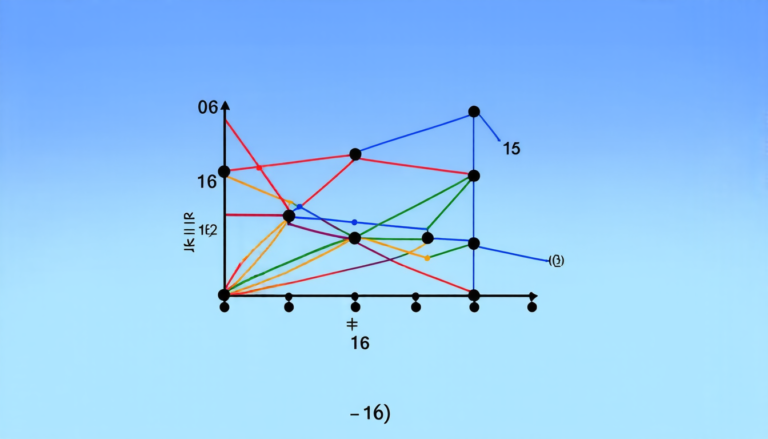

One type of distortion risk measure is called Value-at-Risk (VaR), which represents the maximum potential loss of an investment over a given time period with a certain probability. Another type is Tail Value-at-Risk (TVaR), which takes into account not just the likelihood of a loss, but also its severity.

Researchers have been studying distortion risk measures for some time, and recently, they’ve made some exciting discoveries about how these measures can be applied to real-world financial problems. For example, they’ve found that by combining two counter-monotonic risks – which means that one risk decreases as the other increases – we can create a new risk that is even more extreme than either of the original risks.

This finding has important implications for financial regulation and portfolio management. By understanding how these combined risks behave, regulators can develop more effective policies to manage systemic risk, and investors can make more informed decisions about their portfolios.

Another area where distortion risk measures are being applied is in the calculation of stop-loss premiums. A stop-loss premium is a type of insurance that pays out when an investment falls below a certain level. By using distortion risk measures, researchers have been able to develop new methods for calculating these premiums that take into account the complex relationships between different financial instruments.

One of the key challenges in applying distortion risk measures to real-world problems is the need to deal with non-normal distributions – which means that the data doesn’t follow a traditional bell-curve pattern. Researchers are working on developing new methods for handling these types of distributions, which will be essential for accurately quantifying risk in today’s complex financial markets.

Overall, distortion risk measures offer a powerful tool for managing risk and making more informed decisions about investments.

Cite this article: “Unlocking the Secrets of Risk Management: A Novel Approach to Comonotonicity and Counter-Monotonicity”, The Science Archive, 2025.

Finance, Risk, Distortion, Risk Measures, Comonotonicity, Var, Tvar, Financial Regulation, Portfolio Management, Stop-Loss Premiums

Reference: Chunle Huang, “Distortion risk measures of sums of two counter-monotonic risks” (2025).