Thursday 10 April 2025

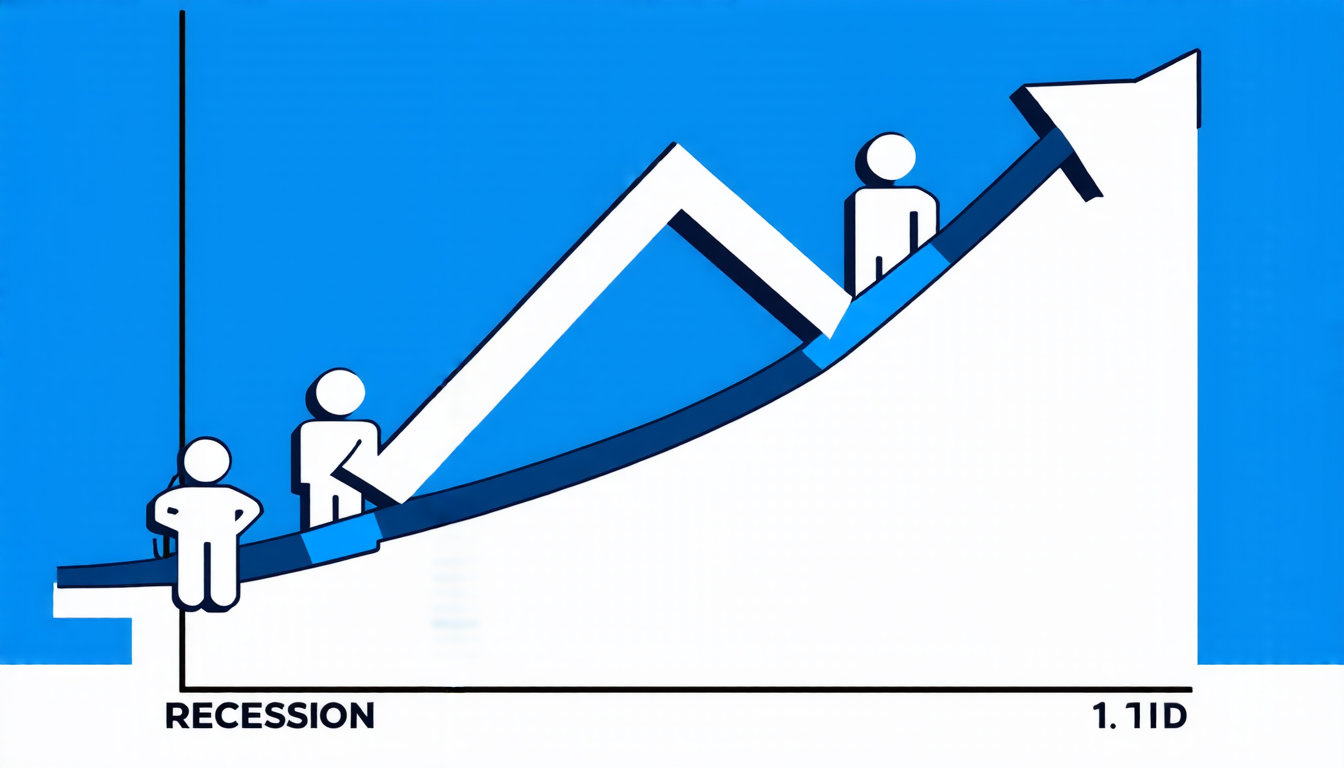

Economists have long grappled with the challenge of predicting recessions, those periods of economic downturn that can leave households and businesses reeling. Now, a new tool is being touted as a game-changer in this regard: the Ebadi Recession Indicator.

This innovative metric combines two powerful signals to forecast when the economy is headed for trouble. The first component is the yield curve, which measures the difference between short-term and long-term interest rates. When investors expect economic growth to slow, they tend to demand higher returns on longer-term bonds, causing the yield curve to invert. This signal has proven remarkably effective in predicting recessions.

The second component is the Sahm Rule, a labor market indicator developed by economist Claudia Sahm. This measure tracks the unemployment rate and job losses to identify when the economy is starting to stall. By combining these two signals, the Ebadi Recession Indicator creates a comprehensive picture of economic health.

In a recent study, researchers put the Ebadi Recession Indicator through its paces using historical data from the US. They found that it outperformed traditional indicators in predicting recessions, often signaling trouble well before it actually arrived. The indicator’s predictive power is particularly impressive during periods of high uncertainty, when economic conditions are most volatile.

One of the key advantages of the Ebadi Recession Indicator is its ability to provide early warnings of impending downturns. By detecting subtle shifts in the economy, it allows policymakers and investors to take proactive steps to mitigate the impact of a recession. This could include adjusting monetary policy or diversifying investment portfolios.

The researchers behind the indicator are keen to stress that it’s not a panacea for predicting recessions. Rather, it’s a valuable tool that can be used in conjunction with other indicators to gain a more nuanced understanding of economic trends. By integrating data from multiple sources and using advanced statistical techniques, they’re able to tease out subtle patterns that might otherwise go unnoticed.

As the global economy continues to navigate choppy waters, the Ebadi Recession Indicator offers a beacon of hope for those seeking to stay ahead of the curve. By providing a more accurate and timely warning system, it could help reduce the impact of recessions on households and businesses alike.

Cite this article: “Unveiling the E-Rule: A Novel Approach to Predicting Economic Downturns with Machine Learning and Traditional Indicators”, The Science Archive, 2025.

Economy, Recession, Indicator, Yield Curve, Sahm Rule, Unemployment Rate, Job Losses, Predictive Power, Economic Health, Policymakers

Reference: Esmaeil Ebadi, “The E-Rule: A Novel Composite Indicator for Predicting Economic Recessions” (2025).