Friday 28 March 2025

The quest for profit in currency markets has long been a game of cat and mouse, with traders seeking out fleeting arbitrage opportunities before they vanish. But what if there was a way to supercharge this process using the power of quantum computing? A team of researchers has made significant strides in developing a system that could do just that.

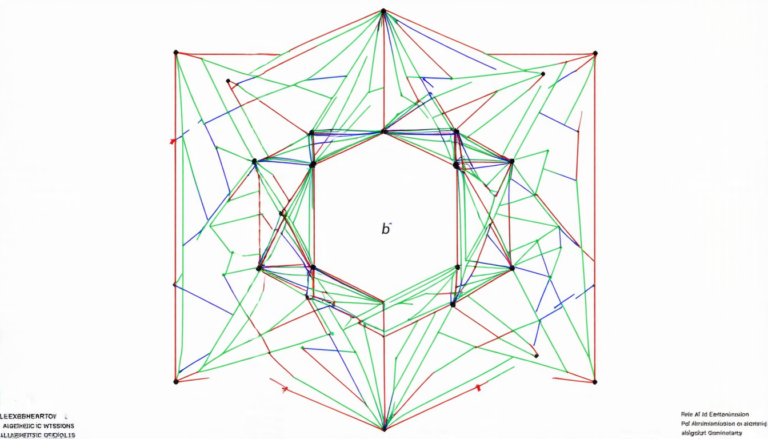

The concept is straightforward: by harnessing the processing power of quantum computers, it’s possible to rapidly identify profitable currency trades that would otherwise be missed. The key challenge lies in translating the complex mathematical equations governing currency exchange rates into a format that can be solved by these exotic machines.

To overcome this hurdle, the researchers turned to two distinct approaches: D-Wave’s quantum annealer and IBM’s Qiskit framework for gate-based quantum computing. Both methods rely on the manipulation of qubits, or quantum bits, which exist in multiple states simultaneously, allowing them to process vast amounts of information in parallel.

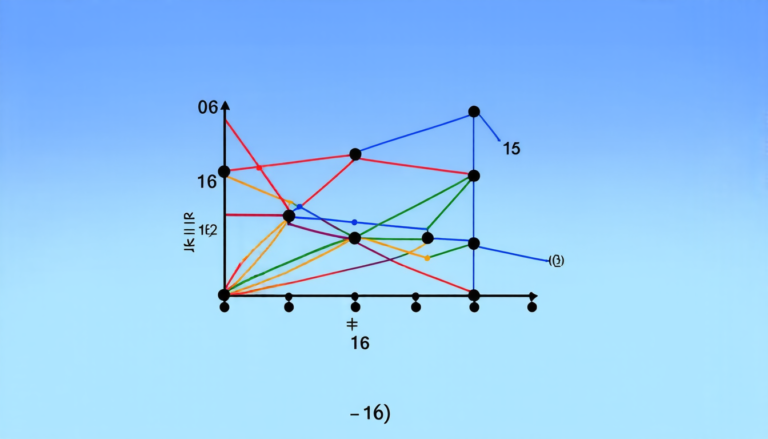

The team began by formulating a Quadratic Unconstrained Binary Optimization (QUBO) problem, a mathematical representation of the currency arbitrage challenge. This was then solved using D-Wave’s quantum annealer, which rapidly converged on an optimal solution. The results were impressive: the system identified profitable trading paths with unprecedented speed and accuracy.

However, when the team attempted to replicate this success using IBM’s Qiskit framework, they hit a snag. Despite its processing power, the gate-based quantum computer struggled to converge on a solution due to the complex nature of the QUBO problem.

The researchers attribute this difference in performance to the unique characteristics of each quantum computing architecture. D-Wave’s annealer is particularly well-suited for solving optimization problems with many local minima, while IBM’s gate-based approach excels at more general-purpose computation.

While these findings may seem esoteric, they have significant implications for traders and investors seeking to capitalize on fleeting arbitrage opportunities in the currency markets. By leveraging the processing power of quantum computers, it may be possible to develop trading strategies that are faster, more accurate, and more profitable than ever before.

Of course, there are also challenges to overcome before this technology can be deployed in a real-world setting. For one, the noise inherent in current quantum computing hardware must be mitigated through sophisticated error correction techniques. Additionally, the complex mathematical underpinnings of currency exchange rates will require further refinement and optimization.

Despite these hurdles, the potential for quantum computing to revolutionize currency trading is undeniable.

Cite this article: “Quantum Leap in Currency Trading”, The Science Archive, 2025.

Quantum Computing, Currency Trading, Arbitrage Opportunities, D-Wave, Ibm, Qiskit, Quantum Annealer, Gate-Based Quantum Computing, Qubits, Quadratic Unconstrained Binary Optimization