Friday 28 March 2025

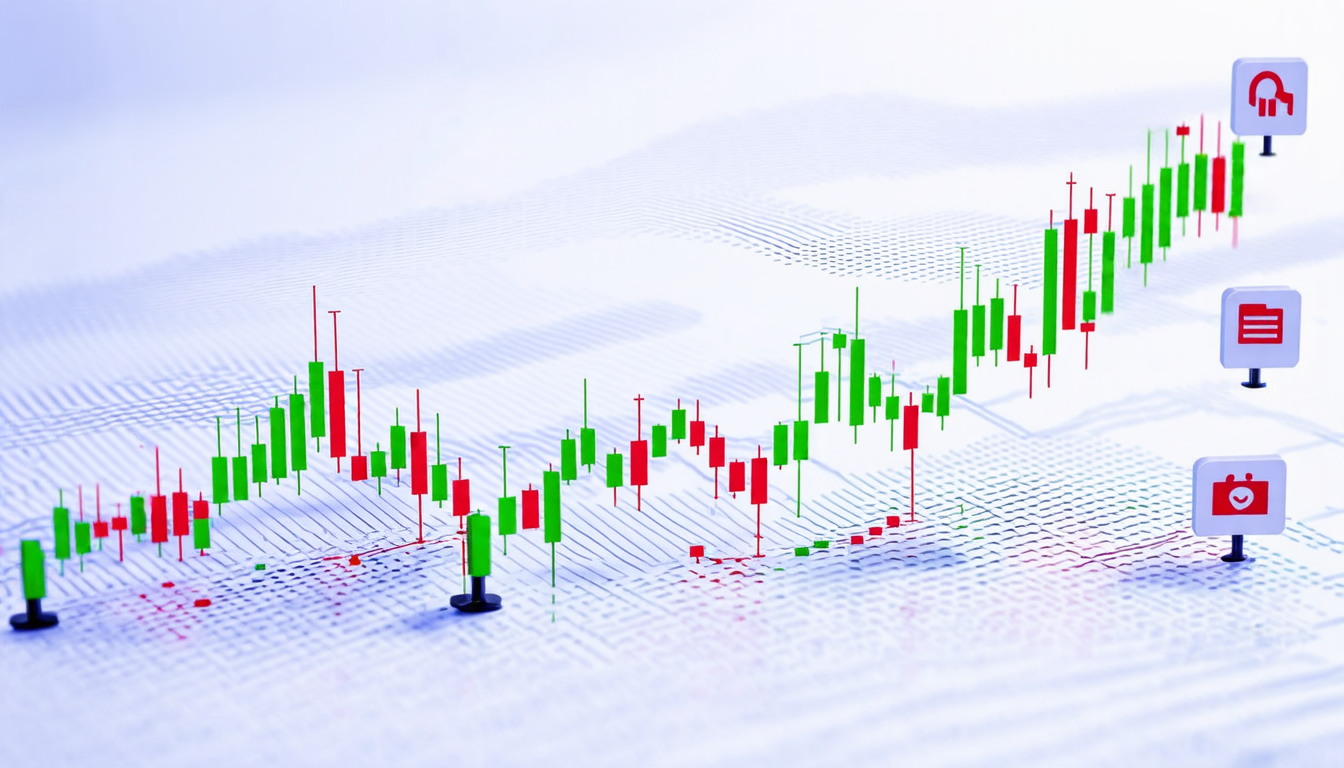

A team of researchers has made a significant breakthrough in understanding the mysterious forces that shape financial markets. By analyzing an unprecedented dataset of trade orders on the Tokyo Stock Exchange, they’ve uncovered new insights into the mechanisms behind market impact – the phenomenon where trades can send shockwaves through the market.

The researchers found that market impact is not just a function of the size and frequency of trades, but also depends on the specific traders involved. They discovered that certain types of traders, known as liquidity providers, play a crucial role in shaping the market’s response to trades. These traders act as buffers between buyers and sellers, helping to absorb and distribute the impact of large trades.

The team used a novel approach to analyze the data, combining machine learning techniques with statistical methods to tease out patterns in the trade orders. They found that the square-root law, which describes how market impact scales with the size of trades, holds true even at the level of individual child orders – small trades that make up the bulk of market activity.

This finding has significant implications for our understanding of financial markets. It suggests that the market’s response to trades is not just a function of the overall volume of trading, but also depends on the specific interactions between traders and the liquidity providers who facilitate their transactions.

The researchers’ results also challenge some long-held assumptions about the nature of market impact. For example, they found that the decay of impact over time, which has been widely studied, is not a universal phenomenon. Instead, they discovered that the rate at which impact decays can vary significantly depending on the specific traders and trades involved.

One of the key takeaways from this study is that financial markets are far more complex and dynamic than previously thought. The interactions between traders and liquidity providers create a intricate web of relationships that shape the market’s behavior in subtle but significant ways.

This research has important implications for investors, policymakers, and regulators. By better understanding the mechanisms behind market impact, they can develop more effective strategies for managing risk and navigating the complexities of financial markets.

The study’s findings also highlight the importance of high-quality data in driving scientific progress. The Tokyo Stock Exchange dataset used in this research is a rare example of a comprehensive and detailed record of trade orders, which allowed the researchers to uncover new insights that might have been lost with lower-quality data.

Overall, this study represents a major advance in our understanding of financial markets, and has significant implications for anyone seeking to navigate the complexities of modern finance.

Cite this article: “Unlocking the Secrets of Market Impact: A New Perspective on Financial Markets”, The Science Archive, 2025.

Financial Markets, Market Impact, Liquidity Providers, Trade Orders, Machine Learning, Statistical Methods, Tokyo Stock Exchange, Square-Root Law, Financial Risk Management, High-Quality Data