Wednesday 09 April 2025

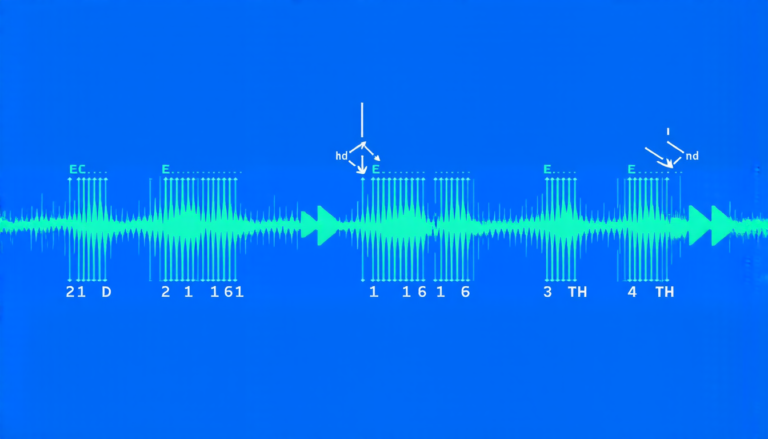

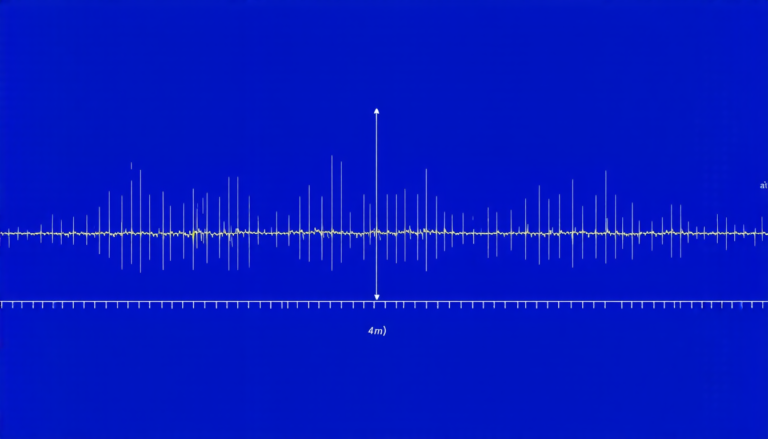

Time series analysis is a crucial tool for understanding and predicting complex systems in fields such as finance, economics, and environmental science. One of the most challenging aspects of time series analysis is dealing with data that doesn’t follow traditional normal distributions, often referred to as heavy-tailed data.

Heavy-tailed data refers to datasets where extreme values are more common than expected under a normal distribution. This can occur in systems where there is a high degree of uncertainty or risk, such as financial markets or weather patterns. Traditional time series models often struggle to accurately capture the behavior of these systems, leading to poor predictions and decision-making.

A recent paper has proposed a new approach to modeling heavy-tailed data using a technique called logistic quasi-maximum likelihood estimation (LQMLE). This method is designed to be more robust than traditional techniques, allowing it to better capture the complex patterns and relationships present in heavy-tailed data.

The LQMLE method uses a combination of mathematical techniques from statistics and signal processing to model the behavior of the system. It begins by fitting a parametric model to the data, which allows for the estimation of key parameters such as the mean and variance. However, unlike traditional methods, the LQMLE technique also accounts for the heavy-tailed nature of the data by incorporating a logistic function into the model.

This approach has several advantages over traditional techniques. For example, it is more robust to outliers and extreme values, which are common in heavy-tailed data. It also allows for the estimation of key parameters such as the tail index, which can provide valuable insights into the underlying system.

The authors of the paper demonstrate the effectiveness of the LQMLE method using a range of simulations and real-world datasets. They show that it outperforms traditional techniques in terms of accuracy and robustness, making it a promising tool for time series analysis.

One of the most exciting aspects of this research is its potential applications in fields such as finance and environmental science. For example, financial institutions could use the LQMLE method to better understand and predict market trends, allowing them to make more informed investment decisions. Environmental scientists could use the technique to model complex systems such as climate patterns or water quality, providing valuable insights into the behavior of these systems.

Overall, this research has significant implications for the field of time series analysis and its applications in a range of fields.

Cite this article: “Unlocking Heavy-Tailed Time Series Models: A Novel Logistic Quasi-Maximum Likelihood Approach”, The Science Archive, 2025.

Time Series Analysis, Heavy-Tailed Data, Logistic Quasi-Maximum Likelihood Estimation, Lqmle, Statistics, Signal Processing, Outliers, Extreme Values, Tail Index, Robustness