Wednesday 09 April 2025

The world of finance is often shrouded in mystery, with complex equations and abstract concepts making it difficult for outsiders to grasp. But a new study has shed light on the intricate workings of financial markets, revealing hidden patterns and connections that could revolutionize the way we invest.

Researchers have long struggled to understand the behavior of stock prices, which can fluctuate wildly from day to day. One of the key challenges is understanding how different assets are connected – do they move in tandem, or does one influence another? To tackle this question, scientists turned to a branch of physics called matrix theory, which has been used to study complex systems like traffic flow and weather patterns.

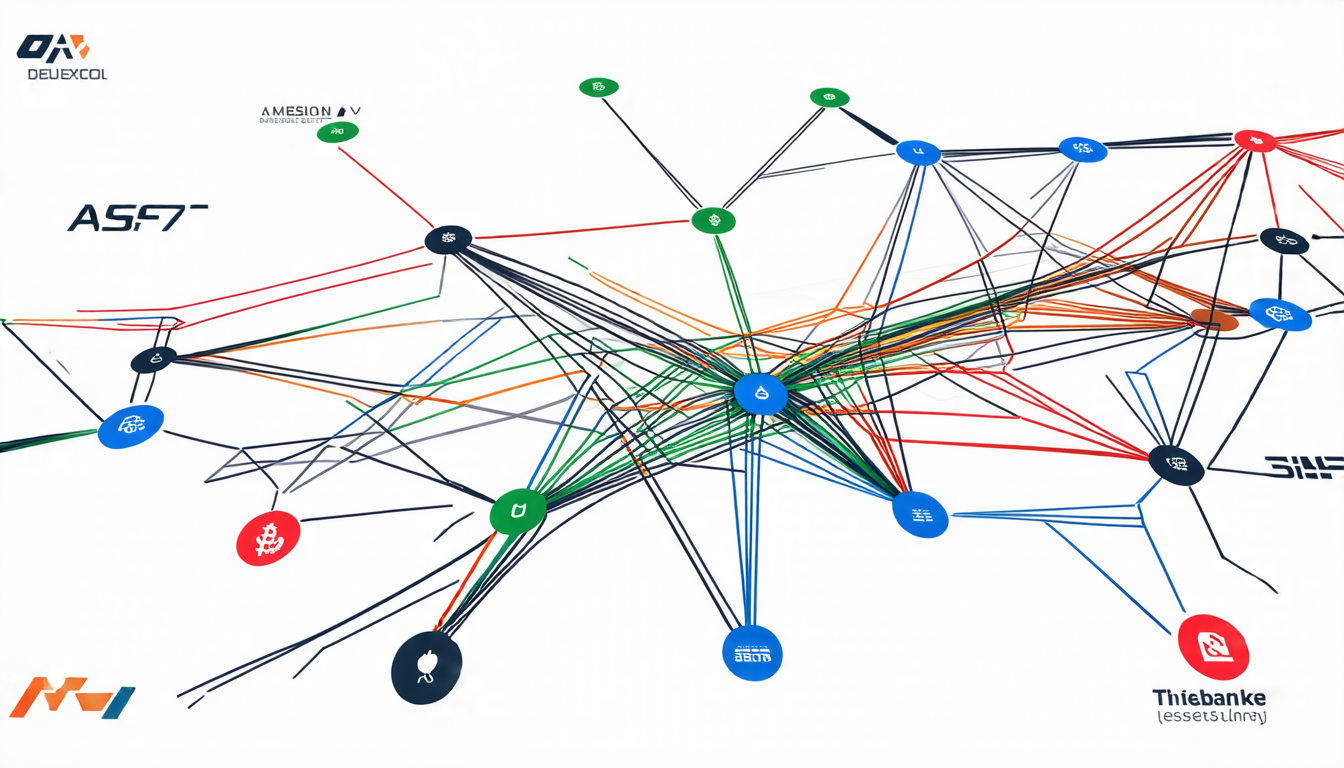

By applying these techniques to financial data, researchers were able to uncover a web of connections between assets that had previously gone unnoticed. They found that certain stocks are more closely tied than others, with some exhibiting strong correlations while others remain relatively independent. This insight could be used to create more sophisticated investment strategies, allowing investors to better diversify their portfolios and reduce risk.

But the study’s findings go beyond simply identifying correlated stocks. The researchers also discovered that these connections change over time, with some assets becoming more or less tied as market conditions shift. This dynamic nature of financial networks means that investors must be prepared to adapt their strategies in response to changing market conditions.

One of the most surprising aspects of the study is its implications for our understanding of financial crashes. By analyzing the network of connections between assets, researchers found that small disturbances can have a ripple effect throughout the system, leading to sudden and dramatic changes in stock prices. This insight could help investors better prepare for and respond to market downturns.

The study’s authors are quick to point out that their findings are still preliminary, and much more research is needed before they can be applied in practice. But the potential benefits are significant – by better understanding the complex patterns and connections within financial markets, we may be able to create a more stable and predictable system for investors.

As researchers continue to refine their techniques and gather more data, it’s clear that this study marks an important step forward in our understanding of financial markets. By harnessing the power of matrix theory and other advanced mathematical tools, scientists are unlocking new secrets about the way money moves – and potentially paving the way for a brighter future for investors everywhere.

Cite this article: “Unveiling Turbulent Patterns in Financial Markets: A Multifractal Analysis of S&P 500 Returns”, The Science Archive, 2025.

Finance, Financial Markets, Matrix Theory, Stock Prices, Asset Connections, Investment Strategies, Portfolio Diversification, Risk Management, Financial Crashes, Network Analysis.