Wednesday 16 April 2025

The world of finance is often shrouded in mystery, with complex models and algorithms making it difficult for ordinary people to understand the risks involved. But what if there was a way to predict extreme events, like market crashes or stock market volatility, without relying on complex mathematical formulas? A team of researchers has made a significant breakthrough in this area, developing a new method that could revolutionize the way we approach risk management.

The key to their approach is an innovative inequality, which provides a simple and reliable way to estimate extreme probabilities. Unlike traditional methods, this inequality doesn’t require assumptions about the underlying distribution of data, making it applicable to a wide range of situations.

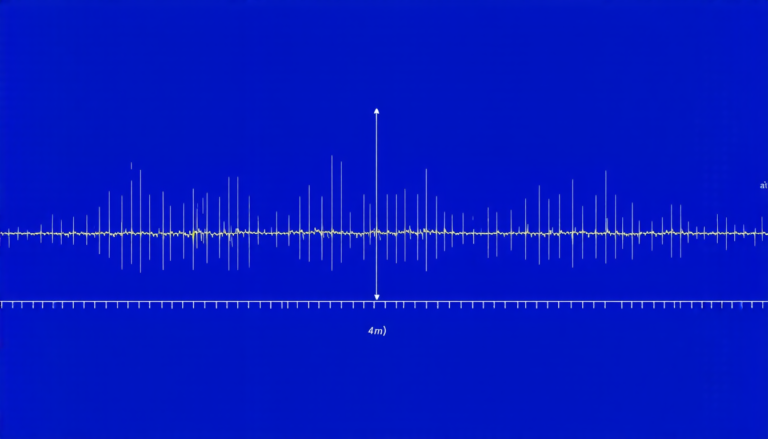

To test their theory, the researchers applied it to historical data on the Dow Jones Industrial Average (DJIA), one of the most widely followed stock market indexes in the world. They found that their method accurately predicted extreme events, such as the 1987 stock market crash and the recent COVID-19 pandemic-induced downturn.

One of the most significant advantages of this new approach is its ability to provide a clear picture of risk without relying on complex models or assumptions. By using real-world data and simple mathematical formulas, investors and policymakers can make more informed decisions about how to mitigate risks and protect their assets.

The implications of this breakthrough are far-reaching, with potential applications in fields such as finance, insurance, and environmental science. In the world of finance, for example, this new method could help investors identify potential hotspots and avoid costly mistakes. In the field of insurance, it could enable companies to better assess and manage risk, leading to more accurate premiums and reduced losses.

The researchers’ innovative approach has also shed new light on the nature of extreme events themselves. By analyzing historical data, they found that these events are not as rare or unpredictable as previously thought. Instead, they often follow a predictable pattern, with certain types of events occurring more frequently than others.

As we move forward in this increasingly complex and interconnected world, it’s clear that understanding and managing risk will be crucial to our success. The researchers’ breakthrough has shown us that even the most seemingly chaotic systems can be tamed through careful analysis and innovative thinking. With their method, we may finally have a way to predict and prepare for extreme events, giving us a safer and more stable financial future.

Cite this article: “Quantifying Uncertainty: A New Approach to Extreme Event Risk Assessment”, The Science Archive, 2025.

Finance, Risk Management, Market Crashes, Stock Market Volatility, Inequality, Data Analysis, Predictive Modeling, Financial Forecasting, Insurance, Extreme Events

Reference: Joan del Castillo, Pedro Puig, “Evaluating probabilities without model risk” (2025).